Help & Support

HLF Digital

Popular Questions

You can use QR code for easier funds transfer via PayNow from another bank to your Hong Leong Finance savings account

- Log in to HLF Digital app

- Tap the Accounts icon, Select Savings Account

- Tap the QR code of the Account where the funds are to be credited to

- Save the selected Account’s QR Code using the Share icon

- Launch the other bank’s mobile banking app

- Select Scan and Pay to scan the saved QR code

Note: Verify that Hong Leong Finance UEN (196100003D001) and your account number are pre-filled correctly - Enter the Amount to transfer

- Submit Transaction and the funds will be credited to your Hong Leong Finance account within 2 business days.

Note: Transfers made to loan and deposit accounts after 4.30pm and 2.30pm respectively will be credited within 2 business days

All existing and new customers with a Singpass account are eligible to sign up for HLF Digital.

For Hong Leong Finance customers with existing account, you can sign up HLF Digital via “Login > Sign up now”.

For customers new to Hong Leong Finance, you can sign up HLF Digital through “Apply Now” which will come with a new Savings Account application.

For Work Pass holder or non-Singpass holder, please visit our branches for assistance.

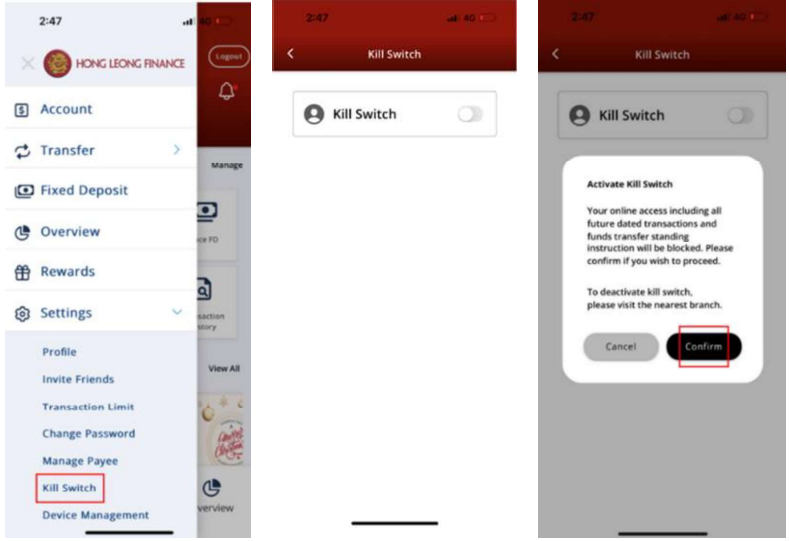

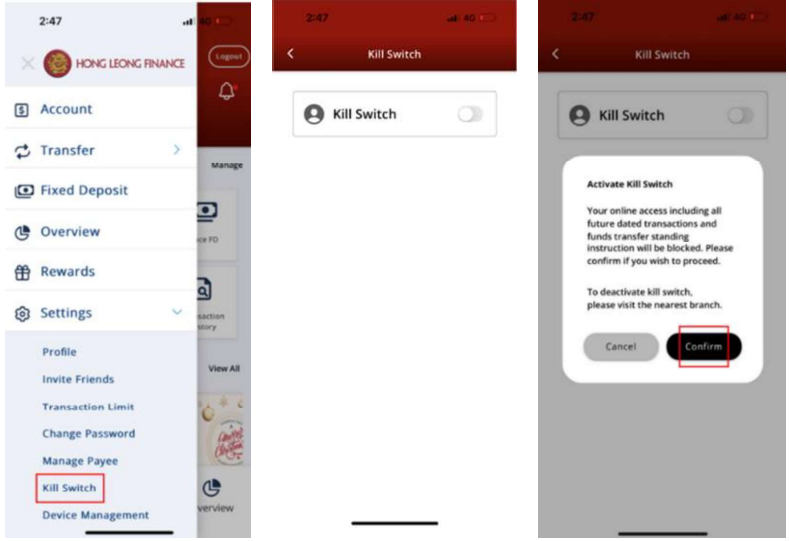

To activate Kill Switch ,

- Log-in to your HLF Digital mobile app;

- Select the side menu

- Select "Settings" tab;

- Select "Kill Switch";

- Toggle the grey button to the right;

- Select "Confirm" to activate "Kill Switch"

You can also activate Kill Switch function through Internet Portal, call Customer Service Centre or visit to our 28 Branches

You can also activate Kill Switch function through Internet Portal, call Customer Service Centre or visit to our 28 Branches Report Suspected Fraudulent or Unauthorised Transaction

If you suspect any fraudulent or unauthorised transaction in your account, you should immediately block on-line access to your account by activating the Kill Switch option in your HLF Digital mobile app (please refer to FAQ below for details on how to activate Kill Switch).

Alternatively, you may contact our 24-hour Customer Service Centre at 6579 6777 or visit any of our 28 Branches Locate Our Branches & SME Centres - Hong Leong Finance for further assistance.

If you suspect that you might have been scammed, you should report to us immediately (please refer to FAQ below on how you can report to us). You are also strongly encouraged to lodge a police report via the Singapore Police Force website or visit any of the Police Stations or Neighbourhood Police Centres.

There are 3 ways you can report fraudulent or unauthorised transaction in your account:

- Contact our 24-hour Customer Service Centre at 6579 6777.

- Report to us at Feedback Form with the following details:

- Full Name (as stated in your ID document)

- Identification number (last 4 characters)

- Contact number

- Account number (last 4 digits)

- Date and time of transaction

- Type of transaction

- Amount of transaction

- Details of transaction (for example what and how it happened)

- Visit any of our 28 Branches. Please refer to Locate Our Branches & SME Centres - Hong Leong Finance for the addresses and operating hours.

Our staff will contact you for further details to aid their investigation into the suspected fraudulent or unauthorised transaction.

To activate Kill Switch ,

- Log-in to your HLF Digital mobile app;

- Select the side menu

- Select "Settings" tab;

- Select "Kill Switch";

- Toggle the grey button to the right;

- Select "Confirm" to activate "Kill Switch"

You can also activate Kill Switch function through Internet Portal, call Customer Service Centre or visit to our 28 Branches

You can also activate Kill Switch function through Internet Portal, call Customer Service Centre or visit to our 28 Branches Currently, you will not be able to deactivate the Kill Switch via HLF Digital mobile app or internet portal. To deactivate Kill Switch, please visit any of our 28 Branches at Locate Our Branches & SME Centres - Hong Leong Finance and our staff will assist to help you regain online access to your account after verification.

If you come across any suspected scams that claimed to be representing Hong Leong Finance, you should report to us via the following ways:

- Contact our 24-hour Customer Service Centre at 6579 6777.

- Report to us at Feedback Form with the following details:

- Full Name (as stated in your ID document)

- Identification number (last 4 characters)(optional)

- Contact number

- Date and time of suspected scams

- Details of suspected scams (for example what and how it happened)

Our staff may contact you for further details to aid their investigation into the suspected scams.

More details on the various types of scams can be found here Security Centre. Please note that the modus operandi of the various types of scams are constantly evolving and you are strongly advised to keep up-to-date with the latest news reports on scams.

You are strongly encouraged to lodge a police report via the Singapore Police Force website or visit any of the Police Stations or Neighbourhood Police Centres for such suspected scams that you come across.

Getting Started

HLF Digital is a mobile device app and web portal services, brought to you by Hong Leong Finance, to let you enjoy the convenience of a range of related services on your deposit and/or loan account with us.

To start using HLF Digital,

All existing and new customers with a Singpass account are eligible to sign up for HLF Digital.

For Hong Leong Finance customers with existing account, you can sign up HLF Digital via “Login > Sign up now”.

For customers new to Hong Leong Finance, you can sign up HLF Digital through “Apply Now” which will come with a new Savings Account application.

For Work Pass holder or non-Singpass holder, please visit our branches for assistance.

Once your information is successfully retrieved from Singpass, you will have the opportunity to edit your mobile number and email address before submitting your application.

Alternatively, you can update your details in Singpass before proceeding with your application.

No, there is no fee. You can download HLF Digital Mobile from Apple App Store or Google Play Store for free.

Log in to the HLF Internet Services portal (https://digi.hlf.com.sg/hlf/sg/ib/) using your user ID and password. Then, use the 6-digit One-Time Password generated by the Digital Token feature in the HLF Digital app to complete the login process.

You can install HLF Digital from Google Play Store or Apple App Store by simply searching for HLF Digital and follow the usual steps for mobile app download and installation.

The HLF Digital works best on the following operating systems

| Device Operating Systems | Best Supported Versions |

|---|---|

| Apple iOS Version | Latest 2 version |

| Android Version | Latest 2 version |

HLF Digital Services will not be accessible on mobile devices that have been jailbroken. Avoid jailbreaking, rooting, or modifying your mobile devices or computers, and refrain from installing or running unauthorized software and applications of unknown origin, as this may result in the unavailability of HLF Digital Services.

You can go to HLF Digital Login page and tap on Forgot User ID/Password to retrieve your user ID or reset your password.

You cannot change the User ID. If you do not remember your User ID, you can login to HLF Digital App, tap Forgot User ID/Password and select Retrieve your User ID.

You can login to HLF Digital and select "Change Password" from the Settings menu.

A Digital Token, also known as a Mobile Token, is a soft token integrated within HLF Digital. It becomes active following a successful initial login and verification of the SMS One-Time-Pin (OTP). Similar to a hard token, our Mobile Token supports Two-Factor Authentication (2FA) and Transactional Signing security features.

In contrast to a hard token, our Mobile Token seamlessly and securely operates within HLF Digital, managing 2FA and Transaction Signing in the background via a PIN, eliminating the need for manually inputting OTP or Transaction Authorization Codes. Embedded within HLF Digital, it enables you to conveniently perform online transactions solely using your mobile phone.

You can self-serve to perform unlock of your digital profile by resetting your password. Please tap on “Forgot User ID/Password?” at Login page to reset password.

For resetting password that require Temporary Pin, you are required to visit branch for assistance.

The Mobile Token is set up through a phone binding process when you sign up to HLF Digital for the first time.

If you are changing to a new phone, log in to HLF Digital with your username and password. Upon successful login, an SMS OTP will be sent to your registered mobile number. This OTP is required to activate your Mobile Token

You can reset your PIN by utilising the "Forget your Pin" link available on any PIN input screen. An SMS OTP will be sent to you for verification purposes. You'll need to enter the SMS OTP to complete the PIN reset process.

Every Hong Leong Finance Ltd customer is limited to registering only one mobile device for HLF Digital. Upon registration of a new mobile device for HLF Digital, the previous device will be automatically deregistered.

You will receive update on the status of your application via email within 3 to 5 business days.

This cooling period of 12 hours is an additional security measure designed to safeguard you. This allows time for verification and security checks before full access is granted to the app's functionalities.

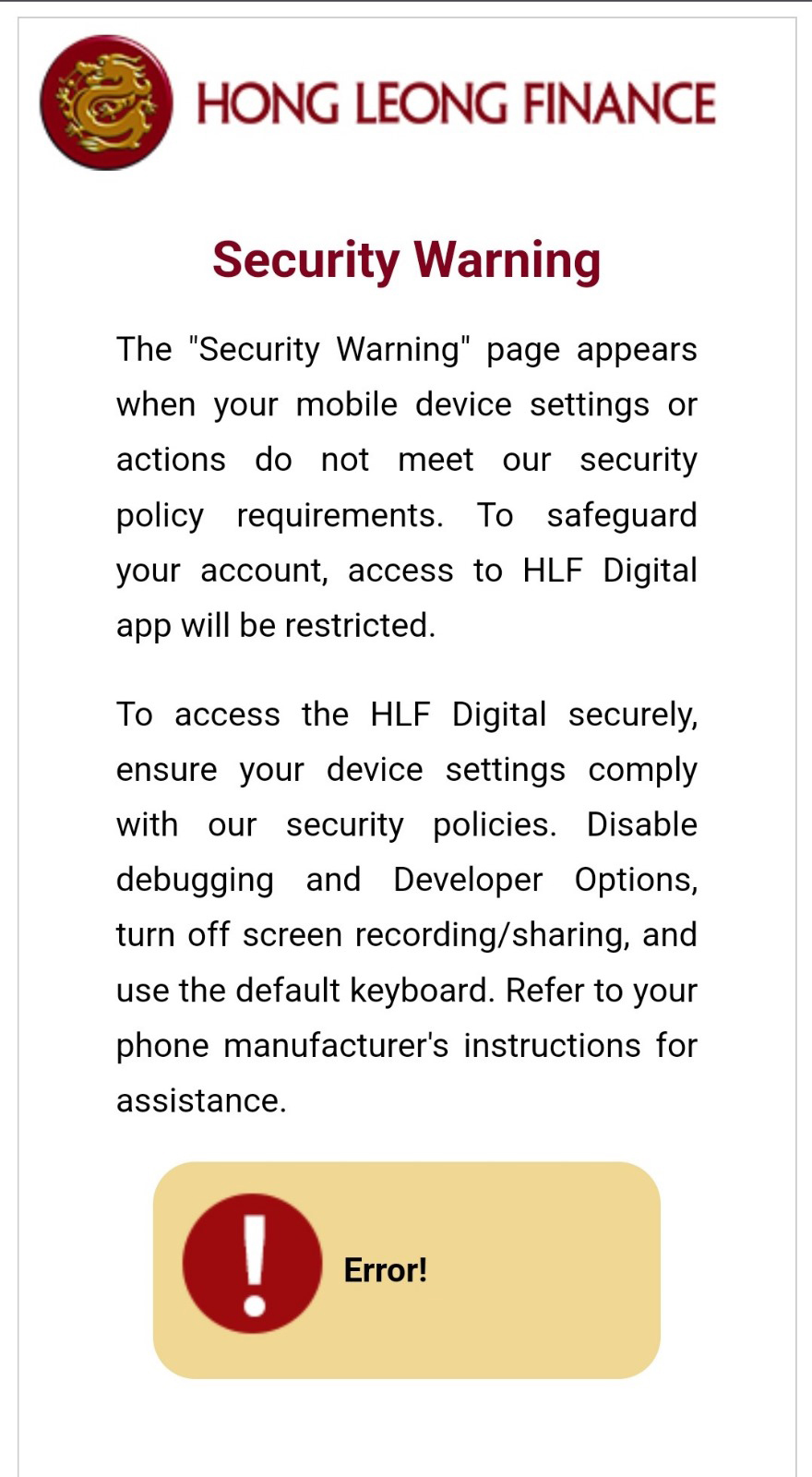

As part of our ongoing efforts to ensure a secure environment and to protect your online data, The "Security Warning" page appears when your mobile device settings or actions do not meet our security policy requirements. To safeguard your account, access to HLF Digital app will be restricted.

To continue accessing the HLF Digital App, you need to disable any risky permission settings (e.g., stop screen sharing, broadcasting, or disable USB debugging via developer options). Please refer to the steps and guidance provided by your phone manufacturer.

No, you can only log in to either one of these channels at a time.

For security reasons, your session will be automatically terminated after 15 minutes of inactivity. You will then need to login again.

We recommend that you perform a remote wipe operation on your misplaced mobile phone by following the steps provided by the phone manufacturer and contact your Telco to deactivate your current SIM card. Afterward, you may download HLF Digital on your new mobile phone with your replacement SIM card, log in to HLF Digital to activate your new Mobile Token. Upon successfully activating your new Mobile Token, the Mobile Token on your lost mobile phone will be deactivated automatically.

At present, there is no online option available for terminating HLF Digital. If you wish to terminate HLF Digital, kindly visit our branch.

No. You can only perform your transactions in Singapore Dollar.

App Features

The HLF Digital app will prompt users to set up biometrics during their first-time login on a mobile device. For Android devices, the biometric option will be fingerprint recognition, while for iOS devices, it will be face recognition.

Alternatively, you can also turn on or off the biometric setting through the following steps:

- Access HLF Digital and login.

- Navigate to Settings in the menu, then select Device Management.

- Select Biometric

- Toggle the grey button to the right to enable biometric login.

Yes. You can use either way which you think is convenient for you.

Kindly access the Singpass website to initiate the password reset for your Singpass account.

If you encounter connection issues while using the mobile app, please log out and retry after some time. If the problem persists, please contact our Customer Service Centre for assistance.

Yes, this feature is close to real-time. An SMS/email notification will be sent after your online access has been successfully blocked. You'll still have access to view your account, but transactions will be prohibited.

We will retain your updated Marketing Consent as long as you remain our customer.

To change particulars:

- Access HLF Digital and login.

- Navigate to Settings in the menu, then select Profile.

- Select mobile number or email address to update.

Note: 12 hours cooling period applies

A Payee is the person receiving the funds.

Yes. By adding new payee securely saves their details, so you don't have to enter account information every time you make a fund transfer. 12 hours cooling period applies for all newly added Payee.

If you no longer intend to pay a saved payee, we recommend deleting them from your payee list. You can find this function under Settings > Manage Payee.

The transaction limit denotes the maximum amount you can transfer within a single day. However, own account transfers are not subject to transaction limits.

Go to the Transaction Limit feature under the Settings menu to adjust your transaction limit. 12 hours cooling period applies for the new increase of transaction limit.

No. there will be no cooling-off period for decreasing the transaction limit. The cooling period is applicable for increasing the transaction limit.

- Apply for HLF Digital access.

- Apply for new deposit products.

- Transfer between your own HLF accounts.

- Transfer to Other HLF accounts.

- Add & Delete scheduled transfer.

- Pay your own Loan with HLF.

- New Fixed Deposit Placements.

- Fixed Deposit e-Services (Available in Internet Portal only).

- View account balances and transactions.

- Download and save eStatement

- Update profile, eg. Email or Contact Number.

- Update Marketing Consent.

You can check the status of your funds transfer via HLF Digital App/internet portal. Subject to accurate information keyed in, the successful funds transfer will be credited into your loan or deposit account. Timing for crediting is as follows:

| Type | Transfer/ Payment credited on |

|---|---|

| Savings Account Transfer within HLF via HLF Digital | The transfer is almost instant. Note: For transactions made after the relevant cut-off time on a business day or on a non-business day, the process date will be the next business day |

| Loan Repayment via HLF Digital using own fund | Payment is almost instant. Loan balance will be updated next business day. Note: For transactions made after the relevant cut-off time on a business day or on a non-business day, the process date will be the next business day |

Over-the-counter transactions may be updated and reflected in HLF Digital App on the next business day.

The scheduled transfer including future-dated or recurring transfers could be unsuccessful due to insufficient balance or your daily transaction limit has exceeded.

Yes, you can cancel any of your future-dated or recurring transfers via HLF Digital.

No, all future dated and recurring transfer instruction will not be processed when kill switch is activated.

Premium Saver, Fixed Savings, Credit Plus, HDB Loans, Hire Purchase Loans, Mortgage Loans.

An e-Statement is an electronic version of your account statement. E-Statements are available for Premium Saver, Fixed Savings, and Credit Plus accounts, excluding the Passbook Savings Account, for past six months. For loan products, e-Statement is available for term loan on a yearly basis.

Yes, you can choose to save your e-Statement by downloading it into your device.

The steps you should take to secure your information include:

- Always remember to log off your HLF Digital App.

- Protect your mobile device with password or biometric authentication.

- Use unique and complex passwords for your account.

- Regularly update your passwords.

- Ensure that your user ID and password remain confidential and that your device is kept secure. Do not share your credentials with anyone.

This measure is to safeguard customers from potential scammers attempting unauthorized transactions. To maintain your security, the cooling period cannot be reduced.

Deposit Enquiries

Yes. Fixed Deposit online placement is available from 9:00 AM to 9:00 PM from Monday to Saturday, excluding public holidays. You may transfer funds from your Savings Account to place Fixed Deposit online.

Yes, all existing and new customers with a Singpass account can open new deposits account online.

For existing Hong Leong Finance customers with HLF Digital access, you can apply new deposits account by logging to HLF Digital app or internet portal.

For customers new to Hong Leong Finance, you can only apply for the Premium SAVER Account (Savings Account) by signing up for HLF Digital using the "Apply Now" on the mobile app. Once your registration and product application are approved, you will be able to apply for other deposit products just like existing customers.

For Work Pass holder or non-Singpass holder, please visit our branches for assistance.

Note: All product applications are subject to approval. Your application outcome will be notified through In App and/or email.

No, you can only apply for a sole name account online. For joint account application, please visit our branch for assistance.

Yes, you can withdraw or renew your Fixed Deposit by submitting an e-Services instruction form up to 14 days before maturity. Simply log in to the HLF Internet Portal to submit your request.

Yes, we can credit the matured Fixed Deposit to your Savings account based on the instruction you have provided in the e-Services Withdrawal Instruction. Simply log in to the HLF Internet Portal to submit your request.

Currently, inter-bank funds transfer is not available in HLF Digital.

You can use QR code for easier funds transfer via PayNow from another bank to your Hong Leong Finance savings account

- Log in to HLF Digital app

- Tap the Accounts icon, Select Savings Account

- Tap the QR code of the Account where the funds are to be credited to

- Save the selected Account’s QR Code using the Share icon

- Launch the other bank’s mobile banking app

- Select Scan and Pay to scan the saved QR code

Note: Verify that Hong Leong Finance UEN (196100003D001) and your account number are pre-filled correctly - Enter the Amount to transfer

- Submit Transaction and the funds will be credited to your Hong Leong Finance account within 2 business days.

Note: Transfers made to loan and deposit accounts after 4.30pm and 2.30pm respectively will be credited within 2 business days

Yes, you can view and manage any of your future-dated or recurring transfers through HLF Digital.

Go to Account or Overview, select the account to view the current balance.

The transaction details will be reflected in the "Transaction History" under the account. You can view your transaction details for up to 90 days.

Please contact the recipient directly for a refund. Alternatively, you may report the incident to our Customer Service Centre for assistance.

Loan Enquiries

No, HLF Digital do not perform loan application. Please contact our Customer Service Centre for more information.

You can view information such as:

- Account Number

- Outstanding Balance

- Monthly Instalment

- Next Instalment Due Date

- Loan Maturity Date

After logging in to HLF Digital, you'll be directed straight to the Home page. The Account section displays all your deposit or loan accounts with Hong Leong Finance. To view detailed information about each loan, simply select the Loans and tap on the individual loan account.

Transactions history is not available for loans.

Yes, you may download and view your yearly loan statement.

Yes, you can pay your monthly instalments through HLF Digital. To do so, you need to have a Savings Account for loan payments. Please note that cut off time is applicable, and the loan outstanding balance will only be updated on the next business day.

Yes, you can repay your loan using the QR code provided in HLF Digital. Please note the applicable cut-off time. Check your loan outstanding balance after 1-2 business days to verify if the transaction was successfully completed.

Fixed Deposit Renewal

Previously, fixed deposits placements were issued with Fixed Deposit Receipts which must be presented or surrendered when a transaction is made. We are now replacing it with a Fixed Deposit Advice and it is not necessary for it to be presented or surrendered. All Fixed Deposit Advices will be auto-renewed upon maturity.

When your deposit is auto-renewed, it means that the principal sum and the interest therein are renewed at maturity for the same tenure as that of the original deposit.

Yes, a Fixed Deposit Renewal Notification Letter, addressed to all account holders, will be mailed to you upon the auto-renewal of your deposits.

However, on or before the maturity of your deposit, you are required to give us renewal instructions for example, to participate in our Fixed Deposit Promotion Campaign. In which case, you may visit any of our 28 branches with your identification document (e.g. NRIC) or make use of the Fixed Deposit Instruction Form.

For fixed deposits placed before 20 Sep 2021, for which a Fixed Deposit Receipt was issued, the Receipt must be presented for withdrawal or renewal.

Yes, you may make a total withdrawal or withdraw only the interest earned or make changes to the tenures of the deposit after it has been auto-renewed. The effective date of the transaction will be from the transaction date.

Please visit any of our 28 branches with your identification document (e.g. NRIC) or make use of the Fixed Deposit Instruction Form.

Yes, we will send a SMS notification to your mobile number registered with us or a reminder letter will be mailed to your last known address as per our record.

Should you misplace your Fixed Deposit Advice, you may request for a statement of account instead. Loss of Fixed Deposit Advice need not be reported.

Fixed Savings Account

The Fixed Savings Account offers a base savings interest rate of 0.25% p.a., which is received on the account balance at month-end. Additionally, it provides an additional high bonus interest rate of up to 1.68% p.a. Bonus interest is received in January of the following year for monthly transfers via FAST made over the past 6 months (i.e., from July to December). The bonus interest cycle repeats in July for transfers made over the previous 6 months (i.e., from January to June). Furthermore, you can enjoy the convenience of saving with monthly FAST transfers to your savings account and a low initial deposit of S$100.

The Fixed Savings Account requires a minimum initial deposit of S$100 and monthly FAST transfers of at least S$200.

Base Interest (p.a.):

0.15% p.a. for Account Balance S$500 to < S$50,000

0.20% p.a. for Account Balance S$50,000 to < S$300,000

0.25% p.a. for Account Balance S$300,000 to ≤ S$2,000,000

Base interest is calculated based on account balance x base interest rate / 365 days x the number of days in the month.

1.28% p.a. for Transfer Amount For the Month S$200 to < S$1,000

1.48% p.a. for Transfer Amount For the Month S$1,000 to < S$5,000

1.68% p.a. for Transfer Amount For the Month S$5,000 to ≤ S$8,000

Bonus interest is calculated based on each monthly FAST amount transfer received x Bonus interest rate / 12 months x the number of months to run before bonus interest payment.

Individuals aged 21 years or above, including Singaporeans, Singapore Permanent Residents (PRs), and foreigners with valid work permits, are eligible to open a Fixed Savings Account.

Visit the nearest Hong Leong Finance branch with your NRIC, Work Permit, Employment Pass or Student Pass. Click here to find Branch nearest to you.

Documents Required:

- Bank account details for FAST transfer

- NRIC (Singaporeans and Singapore PRs)

- Passport and Work Permit (Foreigners*)

* Either one of the documents below for proof of local address:

Utility Bill or Telephone Bill or Bank / Credit Card Statements or Rental Agreement

Yes, Fixed Savings Account is insured up to S$100,000 by Singapore Deposit Insurance Scheme (SDIC).

Savings Account

The Savings Account offers a convenient passbook to help you easily monitor your funds.

The minimum deposit amount required to open a Savings Account is S$100.

Interest (p.a.)

0.100% p.a. for Daily Balance S$500 to < S$49,999

0.150% p.a. for Daily Balance S$50,000 to ≤ S$2,000,000

Individuals aged 15 years or above, including Singaporeans, Singapore Permanent Residents (PRs), and foreigners with valid work permits, are eligible to open a Savings Account.

Visit the nearest Hong Leong Finance branch with your NRIC, Work Permit, Employment Pass or Student Pass. Click here to find Branch nearest to you.

Documents Required:

- NRIC (Singaporeans and Singapore PRs)

- Passport and Work Permit (Foreigners*)

* Either one of the documents below for proof of local address:

Utility Bill or Telephone Bill or Bank / Credit Card Statements or Rental Agreement

Yes, Savings Account is insured up to S$100,000 by Singapore Deposit Insurance Scheme (SDIC).

Premium SAVER Account

The Premium SAVER Account offers high interest rates of up to 1.20% p.a. for savings, with no requirements such as minimum salary credit, card spending, monthly GIRO deposits, or maintaining a minimum balance.

The minimum deposit amount required to open a Premium SAVER Account is S$500.

Savings interest rates (p.a.) for the first dollars :

1.20% p.a. for Deposit Balances from S$500 to < S$200,000

1.08% p.a. for Deposit Balances from S$200,000 to < S$1,000,000

0.88% p.a. for Deposit Balances from S$1,000,000 to ≤ S$5,000,000

Customers who start saving with the minimum amount (i.e., from $500) can earn 1.20% p.a. in interest returns.

While interest is calculated daily, total interest earned will be credited monthly to Premium SAVER Account on the last day of each month.

Individuals aged 15 years or above, including Singaporeans, Singapore Permanent Residents (PRs), and foreigners with valid work permits, are eligible to open a Premium Saver Account.

Visit the nearest Hong Leong Finance branch with your NRIC, Work Permit, Employment Pass or Student Pass and the document required. Click here to find Branch nearest to you.

Documents Required:

- NRIC (Singaporeans and Singapore PRs)

- Passport and Work Permit (Foreigners*)

* Either one of the documents below for proof of local address:

Utility Bill or Telephone Bill or Bank / Credit Card Statements or Rental Agreement

Yes, the Premium SAVER Savings Account is insured up to S$100,000 by Singapore Deposit Insurance Scheme (SDIC).

Corporate Cheque Users

In its November 2021 paper, MAS outlined plans to support Singapore’s move to digital payments. Phasing out corporate cheques will help businesses switch to faster and cheaper e-payment methods. As cheque use falls, processing costs have gone up, making cheques costly and inefficient for banks to maintain.

The last date to request additional cheque books was 15 September 2025.

HLF stopped issuing new cheque books to corporates with effect from 01 October 2025.

The processing of HLF BCA inward cheques will cease on 31 December 2025. BCA cheque payees should present their cheques well before 29 December 2025 to ensure that processing is completed by the deadline of 31 December 2025.

HLF will not be able to process any BCA cheques deposited after 31 December 2025. BCA cheque payee must deposit all corporate cheques by 29 December 2025.

Should the BCA cheque payee miss the deadline to deposit their cheques or have their cheques rejected, they will need to make alternative payment arrangements with HLF BCA customer.

Yes, the last day to deposit corporate cheques issued by your customer for payment will be on 29 December 2026.

BCA customers may submit the Payment Instruction Form with wet-ink signature, in person, at any of our 28 branches for FAST or MEPS+ transfers. All fees will be absorbed by HLF.

A Payment Instruction Form is a document where you authorize the bank to execute a specific payment or transfer on your behalf. It contains details like the amount, beneficiary details, payment method, and execution date.

Yes. To ensure timely processing, please submit the original duly signed Payment Instruction Form to HLF branches by 2:00 PM, Monday to Friday only, for same-day processing.

For Payment Instruction Form received after 2:00 PM, the transfer will be made on the next business day (excluding Saturday).

Please note that payment instructions will not be processed on Saturdays, Sundays, or public holidays.

Yes, contact us immediately if you need to amend the payment instruction.

Changes can only be made before the payment is processed and re-submit the amended instruction.

- Your account name, account number and contact number

- Beneficiary name and account details

- Relationship with Beneficiary

- Amount (SGD)

- Purpose of payment

- Your wet-ink signature(s)

Yes, but the original Payment Instruction Form must be signed in accordance with the account mandate.

Hire Purchase (Vehicle & Machinery)

Pricing / Loan Application

No, direct application is not allowed. Instead, you may approach a car dealer to send in the loan application to us on your behalf.

Your car dealer is able to access the status on your application. You may check with them directly.

If your loan enquiries are related to the approval advice, you may approach your car dealer for clarification.

Direct Debit Authorisation (DDA/Giro)

Upon our receipt of your Giro Application Form, we will send you a letter acknowledging receipt. Upon approval by your banker, another letter will be sent advising you of the commencement date of your Giro deduction. You are advised to continue servicing the monthly instalment prior to your receipt of the second letter.

Please complete the areas indicated with "✓" under Part 1 of the form and return the ORIGINAL form to us. Processing time is about 2 months - from application to approval from your bank.

You may check with your banker on the reason for the rejection. A rejection fee of S$3 will be levied for each unsuccessful deduction. There will only be one Giro deduction per month. You may wish to pay via Cash, Cheque, PayNow or AXS for the outstanding instalment if the Giro deduction is unsuccessful.

Modes of Payment

-

Cash payment at any of our branches

- Cheque to be issued in favour of 'Hong Leong Finance Ltd' and indicate vehicle number or Hire Purchase agreement number AND contact number on the reverse of the cheque. Cheque can be mailed to:

Hong Leong Finance Ltd

16 Raffles Quay

#01-05 Hong Leong Building

Singapore 048581 -

Interbank Giro (to be arranged) - Please submit ORIGINAL Giro Application Form to Hong Leong Finance and processing time is about 2 months - from application to approval from your bank. Thus, please continue to make payment directly to us until we notify you in writing on the commencement date for the Giro deduction

- Payment through AXS via:

- AXS Station

- AXS m-Station (Download Mobile Apps via App Store and Google Play)

- AXS e-Station / internet banking (www.axs.com.sg)

Steps:

- Select 'Pay Bills'

- Select 'Loans' -> Hong Leong Finance

- Select 'Hire Purchase' -> Vehicle

- Key in payment details at the compulsory fields*:

- *Vehicle Number or

- *Agreement Number without any special characters

- *Contact Number

- *Amount (S$)

-

PayNow

Please refer to Frequently Asked Questions - PayNow or PayNow for Deposit or Loan Payment or https://www.hlf.com.sg/help-and-support/paynow.php for steps for payment.

Transaction receipt printout from AXS machine or transaction e-receipt from AXS m-Station / AXS e-Station is a confirmation that your transaction is successful. No further credit advice will be issued by Hong Leong Finance for payment made via AXS.

Please call our Hotline at 6579 6738 and give us the correct details so that the error can be rectified.

Early Settlement of Account

No, only full settlement is allowed.

Please write a letter of notice and sign it off per your signature on the Hire Purchase agreement. Then scan the letter and email it to hploanadmin@hlf.com.sg or fax it to 6323 3271.

Our fax number is 6323 3271.

Calculation of the interest rebate is as follows: -

IR = {n (n + 1) / [N (N + 1)]} x HC

Where:"IR" – Interest Rebate due to Hirer

"n" – Unexpired period of hiring expressed in months

"N" – Original hire period of hiring expressed in months

"HC" – Total amount of hire charges payable under the Hire Purchase Agreement

Settlement can be done at any of our 28 branches.

Business hours

Mondays to Fridays, 9.00am to 4.30pm except for public holidays

Settlement procedure

Hirer must settle the loan personally by producing your original identity card at any of our branches. Alternatively, the hirer may authorize a third party (e.g. the buyer or the car dealer) to settle the loan on his behalf. We will require hirer's prior written authorization with signature to be faxed or email to us first. Please fax to 6323 3271 or email to hploanadmin@hlf.com.sg to facilitate our verification.

On settlement day, your authorized representative must produce the following:

- the original authorization letter signed by you

- his/her identity card and

- the requisite payment

Hirer can settle by way of cash, cashier's order, your personal cheque, via AXS or PayNow.

Please note that authorised third party can only settle by way of cash, cashier's order or via PayNow.

General

You may make the request by emailing to us at hploanadmin@hlf.com.sg and indicate your Hire Purchase agreement number.

You are able to check your outstanding balance / details of your account online once you have signed up for HLF Digital — Mobile and Internet Services. Alternatively, you may make your request via email to hploanadmin@hlf.com.sg, using the Callback Form or contact our Hotline at 6579 6738.

No, we do not send monthly payment advice prior to payment due date. Loan information relating to the agreement number, monthly loan instalment due date and amount can be found in our letter and the Hire Purchase agreement sent to you when the loan commences.

Please call our Hotline at 6579 6738 for assistance.

You do not need to update us. LTA will inform us through Hire Purchase, Finance and Leasing Association of Singapore. We will write to you upon updating of our record.

You can obtain the Update/Change of Personal Particulars Form here. Upon completion, you can email the form to hploanadmin@hlf.com.sg.

Please refer to your Hire Purchase agreement for your instalment due date.

No, changing of loan tenure or interest rate is not allowed after the Hire Purchase agreement is in force.

Upon loan disbursement, which is subject to documentation being in order, we will send the Hire Purchase agreement via registered mail within 7 days. Please email to hpoperations@hlf.com.sg for any assistance.

The tax invoice includes GST on the car purchase. For hirers who are Corporations/and a GST registered company, the tax invoice may be used to claim back the GST. For hirers who are individuals, GST claim is not applicable and therefore the tax invoice is for your information only.

The taxable amount stated may differ from the car purchase price because the price is made up of several components. Of which, some are not subject to GST (e.g. COE, road tax, additional registration fee, registration fee).

Please call our Hotline at 6579 6738 for assistance.

You may wish to contact your insurance agent directly.

Kindly click Locate Us for our branches location and operating hours.

We are sorry that we are unable to assist as we are Hong Leong Finance and not Hong Leong Bank. We are different business entities.

PayNow

Use PayNow for Deposit or Loan Instalment/Interest to Hong Leong Finance

No, but you are required to register PayNow with your participating bank by using your NRIC and/or mobile number.

You can access PayNow from your bank’s mobile app or online banking and make payment to Hong Leong Finance in 3 simple steps via the following methods:

Method 1 - Scan and Pay

- Select Scan and Pay from your mobile app

- Scan Hong Leong Finance SGQR code with the app

- Verify that Hong Leong Finance UEN is pre-filled as 196100003D001 and you are paying to Hong Leong Finance Limited. Enter the amount to deposit/pay and your Hong Leong Finance Account/Agreement Number without any special characters/Vehicle Number in the reference number/description field and submit.

Method 2 - Input UEN No. and Pay

- Select PayNow from your bank's mobile app and pay via UEN.

- Enter Hong Leong Finance UEN as 196100003D001, the amount to deposit/pay and your Hong Leong Finance Account/Agreement number without any special characters/Vehicle Number in the reference number/description field.

- Verify payee information before submission.

You can also refer to our Use PayNow for Deposit or Loan Payment web page via https://www.hlf.com.sg/help-and-support/paynow.php for the illustration of the 3 simple steps.

You can make payment for your Hire Purchase, Mortgage and SME loans.

You can make deposit into your existing Fixed Deposits, Savings, Premium SAVER and Fixed Savings Account.

For depositing into your Fixed Deposit account, please click on this link https://www.hlf.com.sg/forms/form-fdpaynow.php for the online Deposit Instruction Form.

Yes, corporates can use their bank’s business banking online or apps to make payment of loan instalment or interest payment.

After scanning the SGQR code or entering Hong Leong Finance’s UEN 196100003D001, payer can verify the entity name appearing as "Hong Leong Finance Limited" before proceeding with the payment.

Payment made without a valid loan or deposit account number as reference number will be rejected and returned to your bank.

For late loan payments, late charges/interests may apply.

For deposit, Hong Leong Finance will not be liable for interest earn on the deposit.

You can check the status of your funds transfer via your bank’s online banking service. Subject to accurate information keyed in, the successful funds transfer will be credited into your loan or deposit account. Timing for crediting is as follows:

For Loan:

- For Loan payment made by 4.30pm on a weekday, the payment will be credited into your loan account on the same day.

- For Loan payment made after 4.30pm on a weekday or on a Saturday, Sunday or Public Holiday, the payment will be credited into your loan account on the next working day.

For Deposit:

- For Deposit transfer made by 2.30pm on a weekday, the payment will be credited into your deposit account on the same day.

- For Deposit transfer made after 2.30pm on a weekday or on a Saturday, Sunday or Public Holiday, the deposit will be credited into your deposit account on the next working day. For example, transfer made at 5pm on Friday, the deposit will be credited on the next working day.

You can click on this link https://www.hlf.com.sg/help-and-support/index.php for contact numbers relating to loan payments and settlement.

Alternatively, you can call our Customer Service Hotline at 6579 6777 for assistance.

You can click on this link https://www.hlf.com.sg/help-and-support/index.php for contact numbers relating to loan payments and settlement.

Alternatively, you can call our Customer Service Hotline at 6579 6777 for assistance.

Please contact your bank immediately.

Funds Transfer Limit

The limits are based on your arrangement with your bank. Please check with the bank.

You can do multiple PayNow transfers per day or across a few days according to your bank’s daily transfer limit rules. For more information, please contact your bank.

Fees and Refund

No service fee will be charged for using PayNow to make payments to Hong Leong Finance.

No service fee will be charged by Hong Leong Finance for the wrong payment. The amount paid wrongly will be refunded to your bank account after three working days from the date of receipt.

Any excess amount received will be utilised towards payment of your next instalment/interest due.

If you wish to make alternate arrangement, you can click on this link https://www.hlf.com.sg/help-and-support/index.php for contact numbers relating to loan payments and settlement.

Alternatively, you can call our Customer Service Hotline at 6579 6777 for assistance.

General

We are sorry that we are unable to assist as we are Hong Leong Finance and not Hong Leong Bank. We are different business entities.

Loan Payment

- AXS - Choose Pay Bills > Loans > Hong Leong Finance

- Cheque

- CPF Saving - Quick guide on housing loan repayment Giro

- HLF Digital

- PayNow - Scan SGQR or use UEN to pay

- Cash repayment

Pricing Guide

View our detailed pricing guide here.

Contact & Support

Your Award-Winning Financial Partner

© Hong Leong Finance Limited. Co. Reg. No. 196100003D. All Rights Reserved.